Regardless of the double-digit inflation rate that impacted the nation’s economy negatively in the year 2017, the management of May & Baker Nigeria Plc was able to sustain a high growth in both pre and post-tax profits, as it recently announced a Profit Before Tax (PBT) of N605.6 million.

The consolidated audited statement of the healthcare group for the year ended 31 December 2017, showed that the profit rose by 75 percent above the previous year’s figure of N346 million. However, the profit after tax for the current year stood at N371 million. This leapt from N41 million after tax loss in 2016 – a year of seething recession.

Following this impressive growth in its performance for 2017, the Board has okayed a 233.3 percent increase in cash dividends (N196 million) to shareholders of May & Baker.

The press statement from the organisation revealed that the revenue grew by 10 per cent from N8.5 billion in 2016, to N9.4 billion current year. However, cost of sales grew marginally by 2 percent from N5.9 billion prior year to N6.1 billion in the year under review due to increases in materials’ costs, and high power cost. The company resolutely waded through market variances to generate a 29 percent growth in gross profit from N2.5 billion in the previous year to N3.3 billion in the current year.

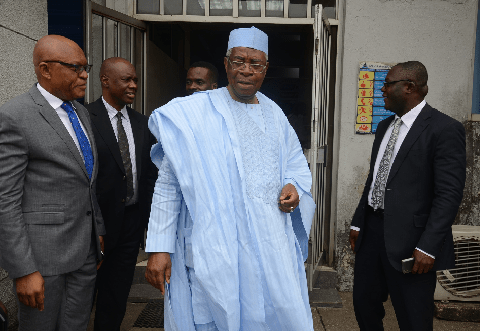

Speaking on the company’s outlook for the new business year, the Managing Director, May & Baker Nigeria Plc, Mr. Nnamdi Okafor, holds the projection that both the global and the local economy will grow in 2018 and May & baker will connect with this growth. He stated that, “The Company will remain focused on its long-term goal of strengthening existing investments and expand new business areas so as to continue to create new opportunities that will grow value and long term returns to all our stakeholders.”

He added that, “May & Baker has a great pedigree and is poised to play beyond the boundaries of Nigeria and break into Sub-Saharan Africa. To drive this, we will continue to acquire necessary competences, engage pertinent partnerships and then keep leveraging our installed capacity at the pharmaceutical facility in Ota to the fullest so as to improve on our numbers year-on-year”.

The document expatiated on the 2017 operating expenses of the company, noting it swelled by 26.5 per cent, posting N1.4 billion against the previous year’s cost of N1.1 billion while Finance cost increased by 22 per cent from N519million last year to N635million present year. This was largely driven by the cash backing requirement for LCs and import financing.

Having operated in Nigeria’s pharmaceutical industry for about 74 years, May & Baker has remained a viable attraction for investment especially as the company’s operational efficiency continues to increase year-on-year. This is manifested in the financial outlook of the company’s 5-year comparative results of pre- tax profits.

In 2013, the group posted a PBT of N11million loss and then bounced back to record a phenomenal N101.17 million profit, the following year. Despite the 2015 “political headwinds”, the company grew its PBT to N142.40 million and then withstood the 2016 scorching recession to announce N345.94 million as PBT. The 2017 profit before tax stands at N605.62 million.

buy medication without an rx buy prescription drugs online without

what is tadalafil: http://tadalafilonline20.com/ 40 mg tadalafil

buy tadalafil online safely – purchase tadalafil tadalafil online